Stock Market Outlook 2025. Is the market overvalued?

Buffett famously said that investors should be “fearful when others are greedy, and greedy when others are fearful.”

The Stock Market Is Overvalued: A Cautionary Tale for Long-Term Investors

In recent years, the stock market has experienced significant growth, with indices reaching all-time highs and investor sentiment running high. However, a closer look at fundamental valuation metrics reveals that the market might be overvalued, especially when analyzed through the lens of two key indicators: the Buffett Indicator and the Price-to-Earnings (P/E) Ratio.

Both of these metrics suggest that the stock market is priced well above its historical average, which raises concerns for long-term investors. In this article, we will explore why the stock market is overvalued, and what long-term quality investors should do in such an environment.

The Buffett Indicator: A Clear Warning Sign

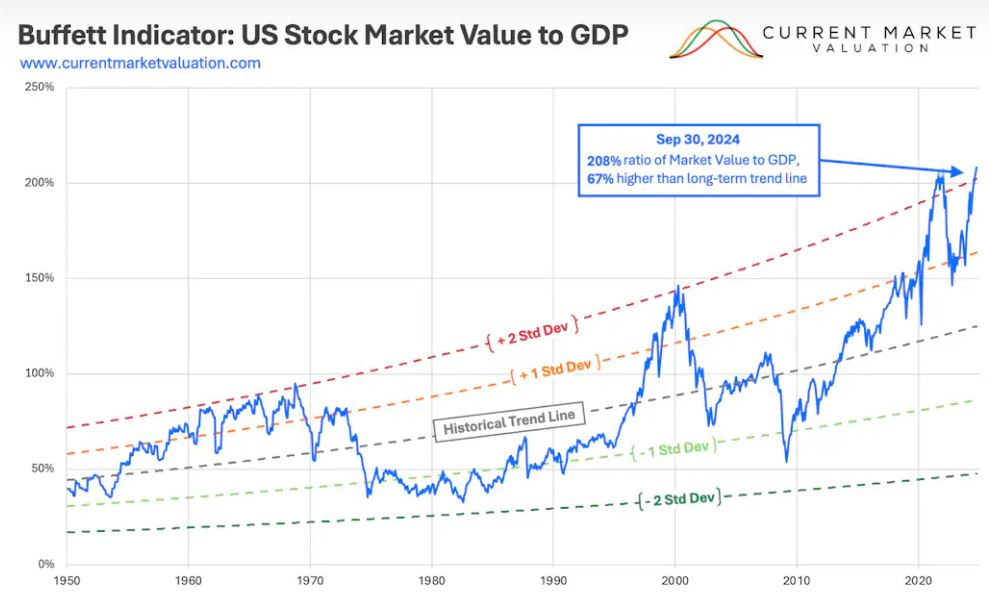

The Buffett Indicator, named after legendary investor Warren Buffett, is a simple yet powerful tool for assessing the overall valuation of the stock market relative to the economy. The indicator compares the total market capitalization of U.S. stocks to U.S. Gross Domestic Product (GDP).

Currently, the Buffett Indicator is flashing a warning sign. According to the data provided by Current Market Valuation, the ratio of market capitalization to GDP is well above its historical average. Historically, a ratio of 100% (market cap = GDP) has been considered a sign of a fairly valued market. However, as of the latest data, the ratio has soared past 160%, suggesting that the market is priced significantly higher than the underlying economy.

Why is this concerning? When the stock market becomes disconnected from the real economy, it can signal the formation of a market bubble. Historically, such high readings have been followed by periods of market corrections or stagnation. Essentially, when the market cap is excessively high relative to GDP, future returns are likely to be lower, as stock prices eventually need to align with the economy's underlying growth.

The chart below, clearly indicates that Buffet’s Indicator is at 208% at the end of Sep 30, 2024 and valuations at end of December are even higher.

source: https://www.currentmarketvaluation.com/models/buffett-indicator.php

The Price-to-Earnings (P/E) Ratio: Another Red Flag

Another common metric to evaluate stock market valuations is the Price-to-Earnings (P/E) Ratio. This ratio measures the price investors are willing to pay for each dollar of earnings generated by a company. A high P/E ratio typically indicates that investors are willing to pay a premium for earnings, which can be a sign of overvaluation.

As highlighted on Current Market Valuation, the Cyclically Adjusted P/E (CAPE) ratio, which smooths earnings over a 10-year period to account for cyclical fluctuations, is at levels far above its long-term average. This indicates that stocks, on average, are expensive relative to earnings, suggesting a market that is overpriced.

For context, the historical average for the S&P 500’s CAPE ratio is around 16-17. However, as of recent data, the ratio is above 30, signaling that investors are paying far more for earnings today than they have historically.

The chart below shows that P/E ratio even at end of Sep 30, 2024 was almost going to Strongly Overvalued territory, where stock market was at the time of Dot com Bubble.

What Should Long-Term Quality Investors Do?

Given these warning signs — the high Buffett Indicator and elevated P/E ratios — it’s important to consider how to approach investing in the stock market during times of overvaluation, particularly for long-term investors focused on quality stocks.

As a long-term quality investor, your primary goal is to build a portfolio that will provide steady, sustainable returns over time. In an overvalued market, this approach requires caution. Here's what to do:

1. Tread Cautiously

When the market is overpriced, even the best companies may be trading at inflated prices. While quality stocks are generally good investments, buying them at elevated prices means you’re taking on more risk. As Buffett has famously said, "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." In overvalued markets, the risk of paying too much for a wonderful company is higher, and long-term returns may be lower as a result.

2. Be Selective with Stock Selection

Rather than buying into the broad market, focus on high-quality companies that are still trading at reasonable valuations. Look for stocks that are undervalued relative to their intrinsic value and those with a strong track record of earnings growth, low debt, and a competitive advantage in their industry. Avoid the temptation to chase stocks simply because the market as a whole is rising.

3. Increase Cash Reserves

In overvalued markets, it’s often a good idea to increase your cash reserves. This gives you the flexibility to buy stocks at more attractive prices when the inevitable market correction or downturn happens. As Buffett himself has often said, "Be fearful when others are greedy and greedy when others are fearful." A high cash position can help you take advantage of future opportunities when prices become more favorable.

4. Focus on Long-Term Trends

Overvaluation doesn’t necessarily mean the market will crash tomorrow. Markets can remain overpriced for extended periods. As a long-term investor, your focus should remain on secular trends and businesses that will thrive in the long run, rather than short-term price fluctuations. This could mean investing in sectors like technology, healthcare, or renewable energy, which are expected to grow over decades.

5. Diversify Your Portfolio

While caution is necessary, diversification remains a key strategy for managing risk. Ensure that your portfolio is well-diversified across different sectors and asset classes, including bonds, real estate, and international equities. A diversified portfolio can help protect against the risk of a significant market downturn.

Conclusion: Patience and Caution are Key

The current state of the stock market, as indicated by both the Buffett Indicator and Price-to-Earnings ratios, suggests that we are in an environment of high valuation, which increases the likelihood of lower future returns. For long-term quality investors, this is a time to tread cautiously. While stocks may continue to rise in the short term, history shows that buying into an overvalued market can lead to disappointing returns over time.

By focusing on quality, being selective in stock selection, maintaining cash reserves, and staying disciplined in the face of market euphoria, long-term investors can navigate these uncertain times and position themselves for success when the market eventually corrects.

Ultimately, patience and prudence will be our greatest ally in an overvalued market. As Buffett often advises, "The stock market is a device for transferring money from the impatient to the patient."